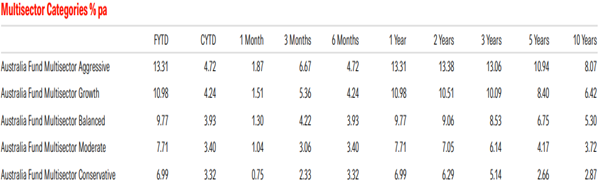

Financial Year Performance 2025

Financial year performance for 2025 is now available and by all accounts it was a very strong year - see table below.

Why didn’t the Reserve Bank of Australia reduce interest rates last week?

The Australian dollar has rallied in the wake of a shock decision by the Reserve Bank to keep interest rates on hold last week.

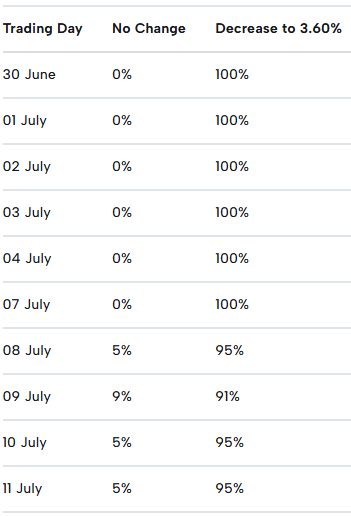

Market pricing ahead of the July meeting had indicated a 95% chance of a 0.25% cut last Tuesday afternoon. It was a split decision among the board members, with six in favour of keeping rates on hold, and three against.

Market expectations of an interest rate change at the next RBA Board meeting in recent days - this calculation is predicated based on ASX Rate Indicator calculation.

Forecasts had shifted almost unanimously in favour of a cut, after the latest inflation data showed consumer prices rising less than expected in May, while economic growth slowed in the first quarter of the year.

However, in its statement, the RBA's monetary policy board said it had judged it could wait for "a little more information (June QTR CPI figures out 30 July) to confirm that inflation remains on track to reach 2.5% on a sustainable basis".

In her post-meeting press conference, governor Michele Bullock opened the door to further easing, indicating the board members disagreed on the timing, rather than the direction, of interest rates.

"While the final scope of US tariffs and policy responses in other countries remains unknown, financial market prices have rebounded with an expectation that the most extreme outcomes are likely to be avoided," it read.

"Trade policy developments are nevertheless still expected to have an adverse effect on global economic activity, and there remains a risk that households and firms delay expenditure pending greater clarity on the outlook."

![]()

Copyright © 2025 Coastline Private Wealth, All rights reserved.