War and investment markets

Markets don’t like uncertainty and war creates uncertainty. As well as the tragic humanitarian impact markets start to worry about the contagion effect – who else is going to get involved, when and in what capacity. In certain regions commodity prices can also be affected, e.g. Oil prices surge as Iran could block oil flow and cause global shortages.

Here are 3 takeaways to consider

1. War often has a surprisingly small impact on financial markets.

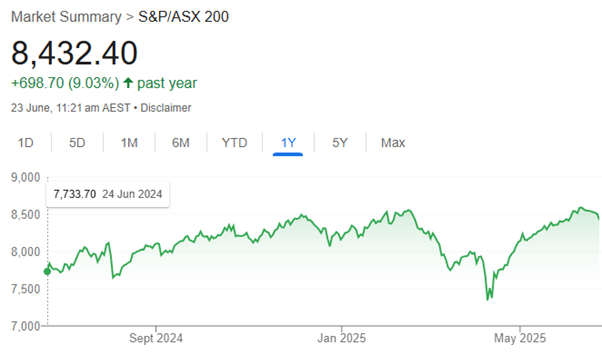

The Australian share market as measured by the ASX 200 is down 1.21% over the last 5 days, however still up 9.20% (plus dividends) for the last 12 months.

The US Share market as measured by the US Dow Jones is down 0.88% over the last 5 days, however still up 7.09% (plus dividends) for the last 12 months.

2. But sometimes war has a big long-term impact (especially if it causes a country to collapse).

It is very hard for a countries financial markets to recover when it spends the next decade rebuilding major infrastructure like housing, roads, utilities etc. Whilst it is good for the economy in terms of employment these projects need to be funded, often by government and private debt.

3. War does not necessarily generate attractive equity buying opportunities for investors.

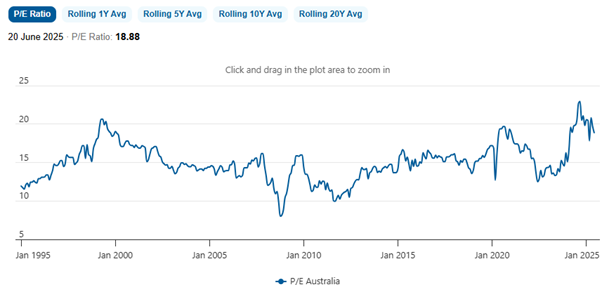

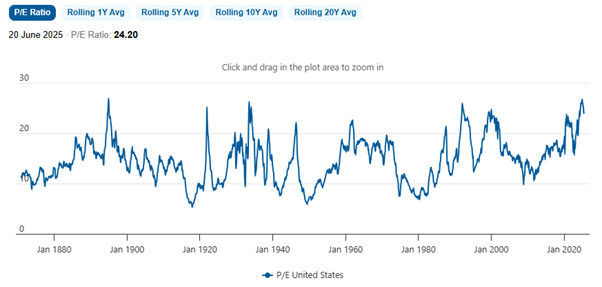

Using P/E to Understand a Company’s Share’s Value

A popular option for evaluating a company’s share price is the price to earnings (P/E) ratio. The P/E ratio provides an indicator of how much investors will pay for each unit of earnings.

Companies use this metric to gauge if their share price is lower or higher than it’s been in the past. It can also be used to compare the value of shares between companies.

Based on the charts below the US continues to be considered “overvalued” and Australia “Fair” value.

Latest Unemployment Figures

A key factor in the Reserve Bank of Australia (RBA) decision making around interest rates is the labour force measured by unemployment.

Last week the Australian unemployment rate remained unchanged at 4.10%. Participation rate remained at 67%. Full time employment increased by 38,700 and part time decreased by 41,100.

The Australian market is currently pricing in an 86% probability of a rate cut in July to 3.60%.

The US Federal reserve kept rates on hold last week.

Copyright © 2025 Coastline Private Wealth, All rights reserved.