UBS has published its annual Global Family Office Report 2025, with insights from 317 single family offices across more than 30 markets around the globe. The average net worth in the survey was USD 2.7 billion, with family offices managing an average of USD 1.1 billion, confirming the report as the most comprehensive and authoritative analysis of this influential group of investors.

About a quarter of family offices UBS spoke to globally were from the Asia Pacific (APAC) region, the second largest region surveyed. The survey was conducted from 22 January to 4 April 2025.

“At a time of increased volatility, global recession fears and following a near unprecedented market selloff in early April, our latest report serves as a good reminder that family offices around the world are first and foremost pursuing a steady, long-term approach, as they focus on preserving wealth across the next generations,” said Benjamin Cavalli, Head of Strategic Clients at UBS Global Wealth Management. “Even with the survey largely conducted in the first quarter, family offices were already acutely aware of the challenges posed by a global trade war, identifying it as the year’s greatest risk. Yet in interviews conducted following the market turmoil that erupted in early April, they reiterated their diversified, all-weather strategic asset allocation.”

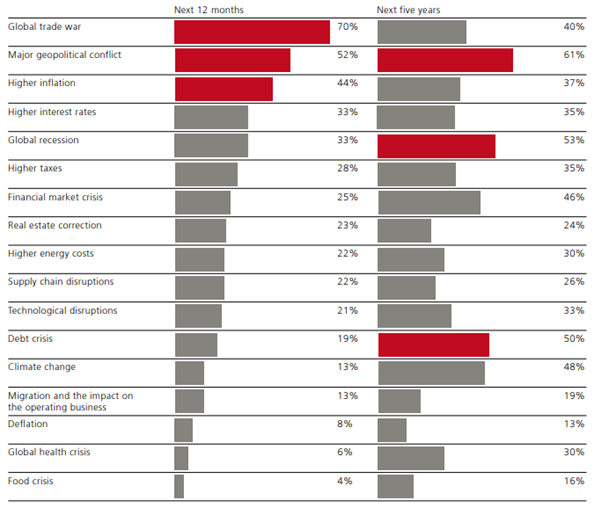

Global trade war is the biggest concern for 2025

When asked about threats to their financial objectives over the next 12 months, more than two thirds (70%) of family offices highlighted a trade war. The second biggest concern for more than half (52%), was major geopolitical conflict, followed by higher inflation. Looking five years ahead, those worried about a major geopolitical conflict increased to 61% and 53% were anxious about a global recession likely off the back of potentially serious trade disputes.

Despite concerns, at the time the survey was conducted, 59% of family offices planned to take the same amount of portfolio risk in 2025 as they did in 2024, staying true to their investment objectives.

However, 38% highlighted the difficulty in finding the right risk offsetting strategy when managing portfolio risks, while 29% pointed out the unpredictability of safety assets due to factors such as unstable correlations. Off the back of this, 40% see relying more on manager selection and/or active management as an effective way to enhance portfolio diversification, followed by hedge funds (31%).

Almost as many are increasing illiquid asset holdings (27%), and more than a quarter (26%) are using high-quality, short duration fixed income. Precious metals, used by almost a fifth (19%) globally, have seen their use grow most of all compared with the previous year, with 21% anticipating a significant or moderate increase in their allocation over the next five years.

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018