Personal Income Tax Cuts – legislation passed late last week

In this year’s annual budget, the Government announced a cut to personal income tax rates, which passed legislation late last week. It was widely expected that the 3-stage proposal would not get passed in the current format and that the bill would need to be broken up in order to attain the cross-bench senators tick of approval.

The Senate however passed the bill in full and now the Government is also pursuing the company tax rate cuts it had previously announced, with this week being the last sitting week before the by elections.

For the 2018/2019 financial year, the federal government announced 3 significant changes to the income tax rules, in the 2018 Federal Budget:

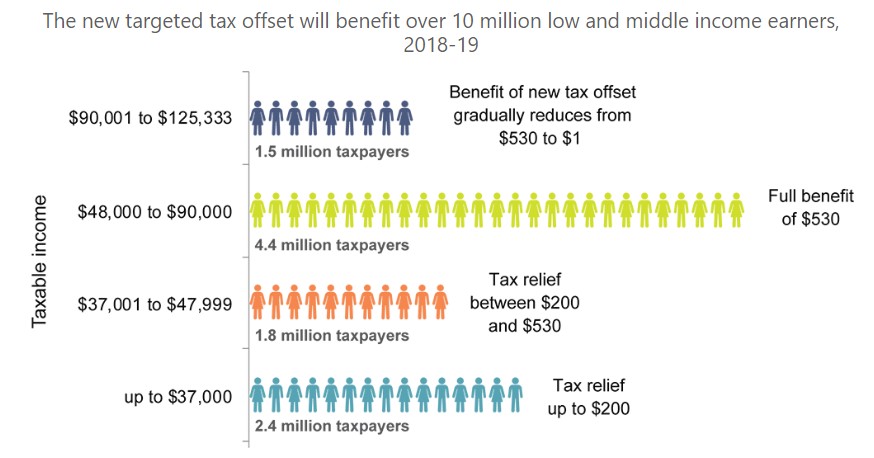

1) The first step will deliver tax relief to low and middle-income earners to help with cost of living pressures. From 1 July 2018 until 30 June 2022 (for 4 years to 2021/22), the application of a Low and Middle-Income Tax Offset (LAMITO) for Australians with a taxable income of less than $90,000. The Low-Income Tax Offset (LITO) will continue to apply, alongside the LAMITO. What is the Low-Income Tax Offset, and how does it work?. According to the federal government, the LAMITO will provide tax relief of up to $530 a year for affected taxpayers and expected to benefit over $10 million people.

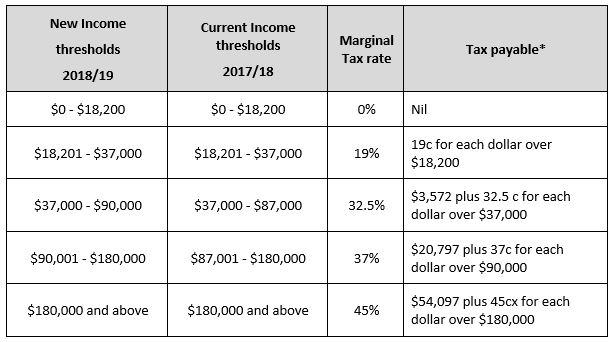

2) The second step expands tax relief to help protect middle income earners from bracket creep. From 1 July 2018, raising the marginal tax threshold for the 32.5% tax bracket to $90,000 (from $87,000) which will provide a tax cut to around 3 million people. Note: that this tax threshold was also raised from 1 July 2016 to $87,000 (from $80,000).

3) Medicare levy will remain at 2%. Previously, the federal government had announced that the Medicare levy would increase to 2.5%, and the additional 0.5% would be directed to the National Disability Insurance Scheme. The increase to 2.5% is no longer going ahead and the federal government is funding NDIS from consolidated revenue.

From 1 July 2018 the following rates will apply:

* You can earn up to $20,542 before any income tax is payable, when taking into account the Low-Income Tax Offset (LITO). For those earning under $125,333, a Low and Middle-Income Tax Offset (LAMITO) will also be available, of up to $530 (subject to legislation).

What’s planned for the future?

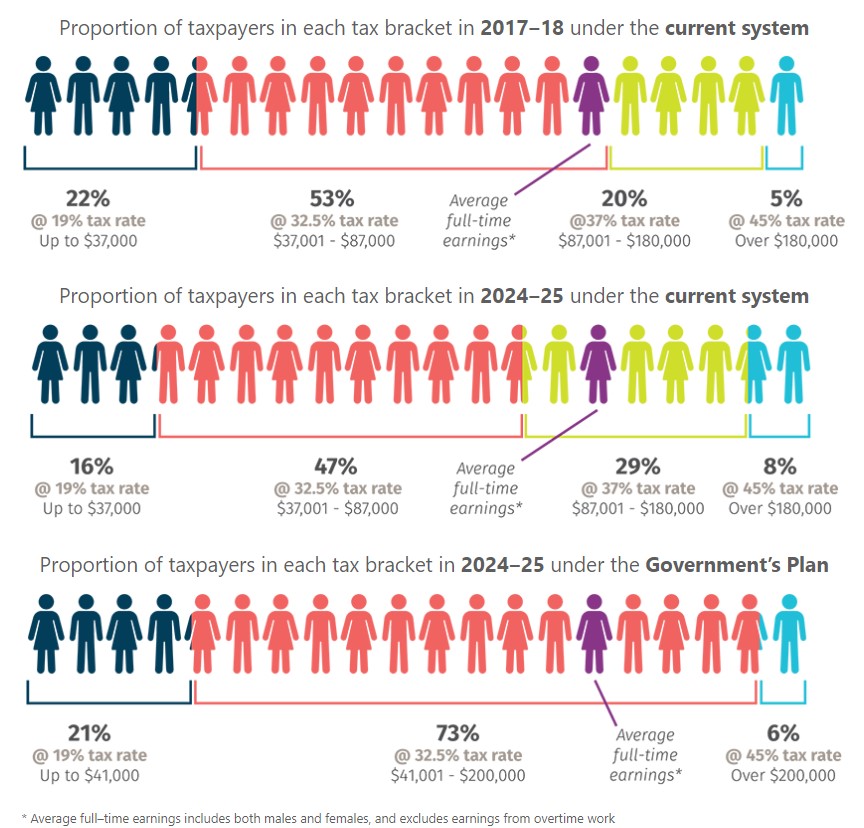

The third step finalises the Government's plan for more Australians to pay less tax by making the system simpler.

- From 1 July 2022, the Government will increase the middle threshold (32.5%) further from $90,000 to $120,000.

- From 1 July 2024, the Government will increase the top threshold of the 32.5% tax bracket from $120,000 to $200,000, removing the 37% tax bracket completely. The plan means that around 94% of all taxpayers are projected to face a marginal tax rate of 32.5% or less in 2024-25. This compares with a projected 63% of taxpayers in 2024-25 without change to current settings.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.