|

Australian demographics are changing: Structural changes ahead

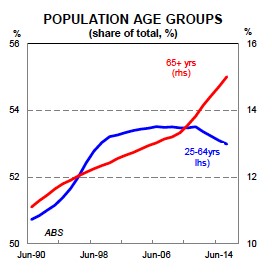

As the chart below indicates the “baby boomers” are growing, and growing rapidly as a % of our overall population. So what are potential ramifications of this structural change to our nation? Are you prepared for the changes ahead and are their opportunities to explore?

- There are less people working so the Governments income tax revenue will fall over the next decade as more people choose to cease employment and retire from the workforce.

- An increase in Government health funding will be required and private health cover premiums will rise rapidly to meet the number of claims paid.

- An increase in Aged Pension funding will be required. It is likely, in our view, that eligibility for the Aged pension will become more difficult to attain and aimed at those that really need it.

- As a result of points 1, 2 and 3 it is likely, in our view, that the Government will increase the age you can access your super savings from 60 to 65 to align with the increase in the Aged pension from 65 to 70. These 2 measures are aimed at keeping people working for longer and preserving their income tax revenue.

- It is likely, in our view, that there will be a tax on the income from self-funded retirees if over a certain level, e.g. 15% if you are earning over $100,000 from a pension fund. Equalising accounts is critical to avoid this.

- The number of Aged Care facilities will need to increase to cater for demand and home care services will need to increase for those that want to stay in their home in the twilight years.

- Inter-generational wealth transfer and estate planning is very important. It is estimated that over $600bn of property assets will be transferred in the next 10 years.

- With modern medicine people are on average living longer. You need to make sure you allow for this in your retirement income goal.

- There will be greater demand for smaller, low maintenance properties. Sub divisions in inner city suburbs will continue to increase.

- There will be too many volunteers as baby boomers look to stay involved in their communities.

Market round up

Global share markets have surged more than 2% after the Bank of Japan unexpectedly cut its interest rate to below zero late last week, its boldest step yet to re-inflate the economy.

Share markets also lifted by weak fourth-quarter US gross domestic product growth data, which bolstered arguments that the Federal Reserve might go slower than expected on future rate hikes.

While a pessimistic outlook has dominated the last 6 months, some sort of balance looks like it is starting to emerge. What happens if there is not a recession? What happens if China stabilises and the Fed doesn't raise rates aggressively?

It has become clear that stock markets cannot stand on their own feet. As long as the economy is shaky and the world is burdened with high debt, central banks and their money printing machines are a necessary evil to keep up the markets.

Kind regards,

The Coastline Private Wealth team.

|